Binance has also come under recent scrutiny after a report by Forbes alleged that crypto exchange used customer deposits for its own undisclosed purposes after a team reviewed on-chain data from. Starting on January 1, 2023, given the newly passed law related to the Infrastructure Bill in the US, crypto brokers (e.g., exchanges) will have to report trades involving digital assets for the calendar year to the IRS on Forms 1099-B or another similar tax form. When Gemini sends a Form 1099-MISC to a customer, the exchange will issue an identical copy to the IRS. Or you mean if you cash out 20k using coinbase? Gemini does not mention whether it would require a subpoena to release this information. In early August of 2019 I received a letter from the IRS stating that, due to info received from a third party, I owed $17,318. But theres another piece to this transaction: the tax gain or loss from holding the bitcoin and then spending it. Include the $55,000 as an expense on your 2021 Schedule C. Jordan Bass is the Head of Tax Strategy at CoinLedger, a certified public accountant, and a tax attorney specializing in digital assets. For 2021, the National Taxpayer Advocate has identified, analyzed, and offered recommendations to assist the IRS and Congress in resolving. I would just assume pay the taxes if it's a minimal amount on your earn, ahem, 'gains.' Key point: The IRS gets a copy of any 1099-K sent to you, and the agency will therefore expect to see some crypto action on your Form 1040. president's term is bullish for stocks, but 2023's gain is probably over by now Gemini users can link their account to TaxBitalong with any other TaxBit Network exchange accountsto a central location. The aggregate amount of all the customers transactions for such year will be reported on Form 1099-K. Many people think if they don't make any money, they shouldn't report it on their taxes. Trading activity on Abra is subject to taxes in the United States and other countries. Now, all of your Gemini transactions will automatically be recorded in your CoinLedger account. dollars on 9/5/21, you should have paid about $51,750.

What is the most crypto friendly country? What is the biggest northern pike ever caught in the United States? In the Tax Documents section of the app, you will see a list of your tax documents. Another frequent question is Does gemini send tax forms?. Gemini doesn't send out the 1099-B but they just sent me a 1099-K today. Why doesnt Gemini send me all of my tax records? If it's a significant amount of money, I like your reasoning.

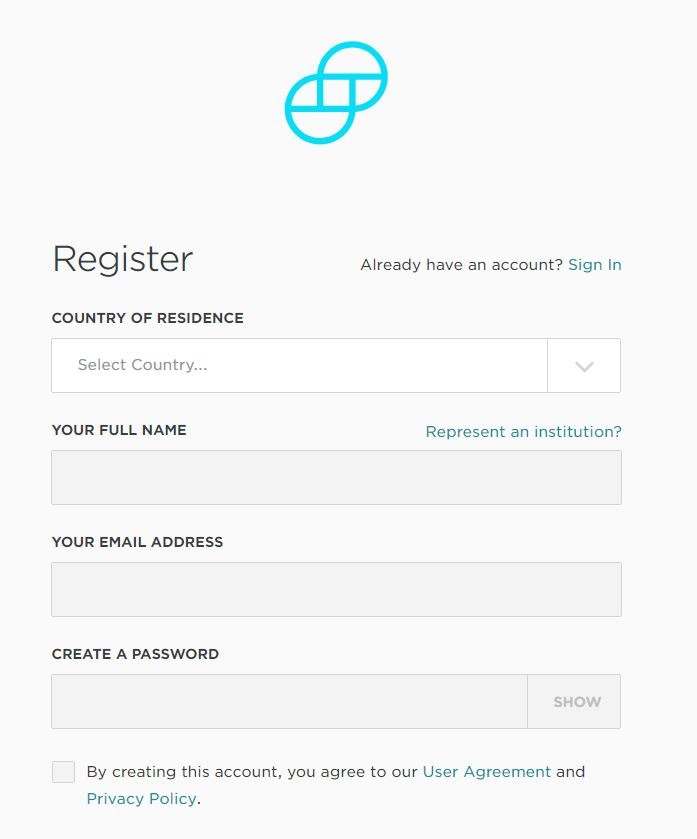

Does gemini exchange report to irs how to#

How to Report Cryptocurrency On Your Taxes. He said he had to contact coinbase on this issue. The platform currently lists hundreds of coins and hundreds of cryptocurrency trading pairs.

0 kommentar(er)

0 kommentar(er)